This blog was originally published on September 16, 2020, and was updated on October 14, 2021, for context and clarity.

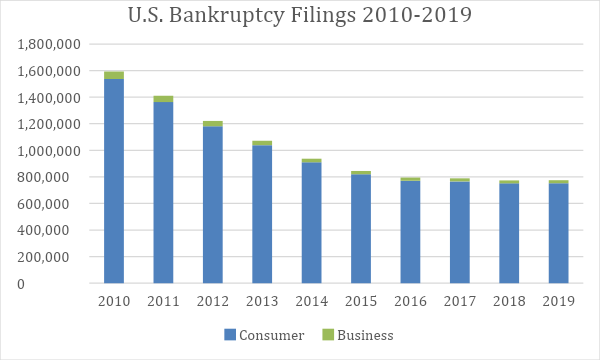

Both consumer and commercial bankruptcy filings have been decreasing year over year since 2010. There are many theories as to why this is; consumers are more spend-conscious after the Great Recession, people simply can’t afford the higher cost of filing for bankruptcy post-2005 BACPA, the economy is stronger and more people are working. But whatever the reason, all indications point to an increase in bankruptcy filings for 2020 and likely 2021 because of COVID-19.

For the purposes of this article, we will be addressing consumer bankruptcies and not commercial/business bankruptcies.

Bankruptcy Filing Statistics 2010-2019

*Source: American Bankruptcy Institute

The top five reasons people file for bankruptcy are:

- Medical Issue/Medical Expense

- Loss of Job

- Poor/Excess Use of Credit

- Divorce or Separation

- Unexpected Expenses

COVID-19 is likely to contribute to medical expenses and loss of job, and some families may experience several of these combined.

While the first two quarters of 2020 did not see a rise in consumer bankruptcy filings (294,387 filings January – June 2020), we have started to hear about more and more businesses filing for Chapter 11 protection. But there are also reasons for the first two quarters remaining low for consumer filings:

- Increase in weekly unemployment benefits

- Stimulus checks of $1,200

- Decrease in collection activity by creditors and debt collectors

- Freeze of evictions

- Freeze of government-backed student loan collections until 2021

- Freeze of garnishments/bank levies on stimulus checks

- Federal student loan relief during the pandemic

- Inability to get to a lawyer to meet/fill out/sign bankruptcy paperwork

However, with so many small businesses closing their doors, many consumers don’t have a job to go back to. For some consumers going back to work, there is less opportunity for income from tips and commissions because there are fewer customers. Stimulus checks have been spent. The additional $600/week in unemployment benefits have been halted and the proposed additional benefits are at a lower amount than the initial additional benefits ($300/week compared to $600/week). Not to mention, many parents need to stay home to be with their children who are not going back to school full time.

What Does Bankruptcy Mean for Creditors?

Most creditors have a strategy in place and have planned for a certain number of their customers to file bankruptcy each year. However, in years where bankruptcy filings take a sharp, unexpected turn, creditors may need to reconsider the amount of loss they may experience because of bankruptcy.

Additionally, because of the decrease in bankruptcy filings over the past 10 years, many creditors have downsized their internal bankruptcy departments. If they haven’t started planning ahead for the rise in bankruptcies already, they may be caught short-handed when it comes to dealing with the increase in bankruptcy volume.

For unsecured creditors who forward their proof of claim filing process to a third-party vendor, now would be a good time to make sure the vendor is ready for the increase in volume.

For secured creditors other than mortgage lenders – the Motion to Redeem, or Cram Down scenario is an event you must keep an eye out for. This scenario happens when the debtor wants to keep their secured property, but they don’t believe the value of the property is equal to the amount remaining on the loan. In these cases, they may file a motion to repay a lower amount than what is currently due on the loan. If the creditor does not respond to this motion within 21 days, they will have to accept the lower amount.

What Does Bankruptcy Mean Mortgage Lenders and Servicers?

With the recent skipped payments because of COVID-19, many consumers will be going into bankruptcy with a far larger arrearage than normal. In March, the CFPB encouraged mortgage servicers to work with homeowners who were struggling with payments due to COVID-19. As a result, many mortgage lenders and servicers have offered short-term payment forbearance programs, such as the one required by the CARES Act. But in many cases, the 180-day grace period offered in the CARES Act just wasn’t enough, and consumers will need to file for relief through bankruptcy.

Have those payments been missed with the blessing of the mortgage company, and added to the end of the mortgage term? Or were they just missed, and will need to be taken care of within the bankruptcy proceedings? If the arrearage will be paid during the bankruptcy period, then mortgage companies must make sure to monitor those cases for the filing of the Notice of Final Cure.

With a very short 21-day response window, and the anticipated increase in the number of cases, it will be very important to keep a close eye on these cases. If a Notice of Final Cure is missed by the creditor, and the debtor is not actually caught up on past due payments, the creditor may have to write off the remainder of the past due if they don’t object to the Notice of Final Cure in time.

Even if you are monitoring for bankruptcies and disposition updates through a data provider, not all data providers provide information for Final Cures and Motions to Redeem. So, you can’t always count on automation to ensure you are protected.

Creditor’s Rights in Bankruptcy

Once a consumer files for bankruptcy, what rights do their creditors have? This depends on a few things. Is your debt secured or unsecured? What chapter is being filed? Are there regulatory restrictions to discharge the debt in bankruptcy (student loans, child support, alimony, taxes, etc.)

- All creditors have the right to know if their debt is included in the bankruptcy. Since the bankruptcy debtor is protected from contact by the automatic stay, creditors have the right to know if they are in danger of violating the stay by contacting the consumer. When a bankruptcy is filed, the debtor provides a list of their creditors. Those creditors form what is called the creditor’s matrix, or a list of all creditors that are a party to the bankruptcy. Bankruptcy notifications are sent to the creditors who are listed on the creditor’s matrix.

Creditors can also be proactive and scrub their active portfolio of accounts through a bankruptcy database. There are several data companies that provide this service. Most will let you know about a bankruptcy filing within 24-hours after the bankruptcy has been filed. Creditors can also opt to receive disposition updates from these data vendors throughout the lifecycle of the bankruptcy.

- All creditors have the right to attend the 341 Hearing, also known as the First Meeting of Creditors. If the creditor would like the opportunity to bring up anything to the bankruptcy trustee, debtor’s attorney, or debtor, this is the chance to do so without violating the automatic stay.

- Secured Creditors have the right to protect their property. When a consumer files for bankruptcy and still owes money on property (house, vehicle, jewelry, etc.) they don’t just get to keep the property without paying for it. The consumer must tell creditors (though the bankruptcy schedules filed with the court), what their intent is relating to the property. Do they intend to keep it and pay for it? Do they intend to return it? If the creditor feels their property is in danger of being harmed, there are legal remedies through the bankruptcy court to lift the automatic stay and take possession of the property.

- Secured and Unsecured Creditors have the right to file a proof of claim in a chapter 13 or chapter 7 case that has assets, in order to recoup some or all of their debt. While secured creditors will generally get paid a higher percentage of what is owed to them than unsecured creditors will, all creditors can request to have their debt repaid in chapter 13 and chapter 7/asset cases.

Reaffirmation agreements generally happen in chapter 7 cases when a debtor wishes to keep certain property that would otherwise be given back to the creditor if they do not intend to pay the remaining balance. If a debtor chooses to reaffirm a debt, terms are agreed upon between the creditor and the debtor as to the amount that will be repaid, and what the repayment terms are.

The reaffirmation agreement is then filed with the bankruptcy court and the debt becomes a legal obligation that is paid outside of the bankruptcy process. If a debtor fails to make payments on a reaffirmed debt, the creditor has the right to pursue collection efforts.

How do Creditors Get Paid in Bankruptcy?

There are several ways a creditor may get paid through the bankruptcy process:

- Secured Creditors in both chapters 7 and 13 will either reaffirm the debt via a reaffirmation agreement or once past due amounts are caught up, they may choose to refinance the loan.

- In chapter 13, secured claims are priority debt and will be paid at 100%. Priority debt includes back alimony, child support, and most tax debts. Mortgage past due payments will be paid at 100% if the consumer chooses to keep their house. Other secured debt past due payments will be paid 100% if the consumer wants to keep the property.

- How do unsecured creditors get paid in a bankruptcy? As mentioned above, in chapter 13 and chapter 7/asset cases, a proof of claim is filed with the court to provide balance information and proof of the debt. The bankruptcy trustee gathers the claims, reviews the debtor’s assets, and determines how much can be paid back to each creditor. A chapter 13 case repayment period is between three and five years. Unsecured claims are paid between 0% and 100%. The amount of repayment depends on the total value of nonexempt property, the amount of disposable income the debtor has each month to pay toward debts, and how long the plan lasts.

No matter if you are a secured or unsecured creditor, you have certain rights when a consumer files bankruptcy. Exercising those rights starts with knowing when a consumer has filed for bankruptcy. Best practice suggestion is to contract with a data provider to monitor your active portfolio of accounts for bankruptcy filings, as well as important disposition updates after the bankruptcy has been filed.

An increase in bankruptcy filings is on the way. Now is the time to plan for how your financial institution will respond. Are you ready?

NeuAnalytics provides an advanced and unique Software-as-a-Service solution for financial institutions and large corporations to manage receivables and mitigate compliance risk. Our modular-based platform allows our customers to choose the products they need to create a customized toolset that allows them to increase efficiencies, reduce compliance risk and increase dollars collected.