On August 24th, Ryan Neuweg, CEO and Founder of NeuAnalytics, and James McCarthy, Partner at McCarthyHatch Consulting, presented a webinar that provided information, insights, and key takeaways for creditors relating to Regulation F. If you’d like to view the webinar presentation, the link is provided at the bottom of this blog post.

While initially creditors may think that Reg F doesn’t apply to them, many key takeaways were provided showing why creditors should not only be aware of Reg F, but should also review their current processes, policies, and procedures to ensure compliance across their debt collection agencies. Additionally, creditors must monitor and audit their third-party collection agency vendors for Reg F compliance, which means creditors must have a working knowledge of the regulation.

The History of Regulation F

Reg F has been 44 years in the making. Since the FDCPA was first enacted in 1977, the way people communicate has changed considerably. We’ve added cell phones, text messaging, email, online chat, and let’s face it, many people completely communicate via apps on their cell phones. It’s the preferred way to communicate for most consumers. And now the FDCPA has caught up with those changing communication habits. The CFPB is providing guidance on how to use them and still protect consumers.

The CFPB has made it clear that the “P” in their name is what drives their actions. Just seeing the numbers is eye-opening. While enforcements have slowed a little in recent years, they’ve been on the rise since 2018 and in 2020 they jumped back up to the 2nd highest calendar year since the CFPB was created.

- $12,900,000,000 in consumer relief

- $1,600,000,000 in fines

- $2,125,000,000 largest single fine related to poor systems integration

- $186,000,000 largest single collections-specific fine

- 48 enforcement actions in 2020 – 2nd highest ever

Regulation F Requirements

Reg F itself contains 7 new categories of regulation, 30 sub-categories, and requires 30 audit controls. This will require new inputs to you from your collection vendors including enhanced data, omni-channel consent, complaint, dispute data, and more. The key focus areas are data accuracy, contact strategy, and disclosures.

- Accuracy: Creditors should ensure that their third-party debt collection agencies are passing accurate data to them, so they can accurately monitor and ensure compliance with the regulations. Most creditors believe their data accuracy is good if not great, but it has been our experience at NeuAnalytics that the first files received from our client’s agency vendors contain a much higher level of inaccuracies than our clients thought, generally between 7 and 10% of data provided is inaccurate. Our first job with every onboarding is to get the vendor data accurate, so monitoring and reporting is accurate. Overall – creditors should strive for less than 1% reconciliation discrepancies with their vendor’s data.

- Contact Strategy: Not only are phone calls limited to 7 calls within a 7 day period with a waiting period of 7 days after an RPC (some exceptions apply), but there are now rules for emailing and texting consumers. There is also a new requirement for creditors who send a consumer’s email to an agency with the purpose of using it to contact the consumer. You should be reviewing your agency’s omni-channel communication strategy, policies, and procedures relating to that strategy and each communication method, as well as their opt-in/opt-out process.

An additional and potentially tricky new requirement in Reg F is to track a consumer’s preference for contact, especially when a consumer states that a certain time is inconvenient for them to be called. For example, a consumer can say “I coach a little league team on Tuesdays and Thursdays from 5:00 – 7:00, please do not call me during that time” and your agency must be able to restrict their calling during that time slot.

In the past, many agencies responded to requests like this by simply blocking all calls to that consumer. But that is not a reasonable strategy going forward. This will also likely be a big attempted ‘gotcha’ from consumer attorneys.

- Disclosures:

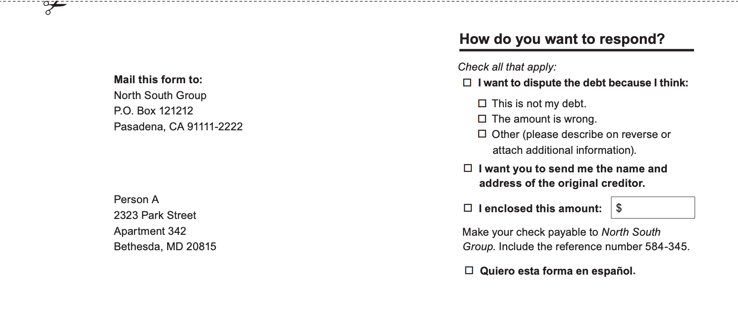

- Validation Notice: The final rule requires a debt collector to provide a process for consumers to use to dispute the debt, request information about the original creditor, or take certain other actions. The CFPB is suggesting this be in the form of a tear-off section at the bottom of a model validation letter they have also provided a template for. The final rule provides a safe harbor for compliance with these disclosure requirements for debt collectors who use the model validation notice or certain variations of the notice.

Additionally, both itemization date and balance breakdown are required for the validation notice:

-

- Itemization Date – the CFPB would like to provide consumers with another data point to help them identify the debt. One of five dates is acceptable, and as the creditor, you must be able to pass the date your agency will be using to them.

- Last Statement Date

- Charge-Off Date

- Last Payment Date

- Judgment Date

- Transaction Date

- Balance Breakdown:

- Balance as of one of the above dates

- Interest between that date and today’s date

- Fees between that date and today’s date

- Payments or credits applied between that date and today’s date

- Current Amount Owed

- Itemization Date – the CFPB would like to provide consumers with another data point to help them identify the debt. One of five dates is acceptable, and as the creditor, you must be able to pass the date your agency will be using to them.

Sample ‘tear-off’ section of the validation notice

- Debt Parking/Delayed Credit Reporting: Requires debt collectors send communication about the debt to the consumer prior to reporting that debt to a credit bureau.

- Time-Barred Debt: Prohibits a debt collector from taking legal action or threatening to sue a consumer to collect time-barred debt.

Creditors Are Responsible for Their Vendor’s Actions

So yes, creditors, you are responsible for what your collection vendors do, what they say, and how they treat your consumers.

We have seen more and more vicarious liability suits filed in recent years, and it’s only going to get worse. Creditor’s attorneys will be on the lookout for any and all violations of Reg F starting December 1st.

The CFPB has provided us with the speed limit………so now we can tell who is speeding.

Creditors can take steps now to start preparing for the November 30th launch of Reg F. Your plan should include attention to your people, your process, and your platform. All should be in working order by November 30, 2021.

- People:

- Prepare your teams for the future. Educate them on Reg F and the requirements of your agency vendors.

- Provide your teams with the tools they need to be most effective.

- Get your decision-makers on board so they can approve whatever actions and budget are necessary.

- Processes:

- Build out your processes to help teams manage the workload.

- Update your policies and procedures to reflect how you will handle Reg F.

- Get updated policies and procedures from your agencies relating to Reg F, communication methods, opt-in/opt-out, etc.

- Update your vendor audits to include Reg F items.

- Ensure you are providing the correct data to your agencies for proper breakdown of the balance.

- Ensure you are providing your agencies the date needed for the validation notice.

- Platform:

- Ensure your platform can handle the additional data and monitoring you will need for Reg F. Each of your vendors likely has different systems, and data integrity is important.

- Invest in automating as much vendor risk assessment and monitoring as possible. Your return on investment will come back to you tenfold.

The Cost of Failure

As I mentioned at the start, CFPB fines are large, and we have been seeing a growing number of enforcement actions in the past few years.

With billions of dollars in fines, failure is quite costly, but that’s just the monetary cost. Your reputation is also at stake. Negative press about consumer harm can do damage not only for future customers, but it could damage your relationship with current customers as well.

Take time now to prepare for the November 30, 2021 go-live of Regulation F. Talk to your vendors, talk to your staff, and get your people, processes, and platform ready because failure is not an option.

To learn more about NeuAnalytics and how we are preparing creditors for compliance with Regulation F visit us online to request a meeting with one of our compliance experts.

Our platform takes the guesswork out of monitoring your collection vendors, not only for Reg F compliance, but for dozens of other regulatory audits. Our automation gives creditors peace of mind when it comes to managing their vendors to the regulations by monitoring every account every day for compliance.

Watch the webinar November Go-Live for Modernized FDCPA here.